All Of Us are usually not really a comparison-tool in addition to these types of cash advance using cash app provides usually perform not symbolize all obtainable deposit, investment decision, financial loan or credit score items. If an individual don’t pay off your own financial loan simply by typically the deadline—you obtain a grace period associated with 1 few days to become capable to acquire your take action together. Afterward, Cash Application will charge a person a weekly just one.25% late fee.

What Will Be The Interest Price Regarding Borrowing Through Cash App?

General, the particular repayment process via Money Application Borrow will be straightforward and effortless to understand. Simply make positive in order to choose a repayment program of which functions with regard to a person, set up programmed repayment when feasible, plus create your current payments about time to prevent any type of costs or fees and penalties. If you’re anxious concerning missing a payment, an individual could established upwards programmed repayment through Cash Software. This will make sure that your current payments are usually manufactured upon moment and you won’t have got in order to get worried about virtually any late fees or fines. Money Software offers a couple of diverse repayment programs, which includes a one-time transaction, a two-week plan, and a four-week program. You’ll want to select the strategy that performs best with regard to a person based on your economic scenario in inclusion to ability to become able to pay back the particular mortgage.

You could today easily apply for $50, $100 or $150 through these types of payday advance programs in add-on to obtain it within just several hours. If an individual have got no present loans and have made normal debris upon the particular software, but nevertheless are not in a position to access this specific feature then take into account calling the particular Cash Application customer care. There is usually a opportunity that your current credit score report or credit rating historical past is keeping them coming from extending this particular option to become capable to you. Their customer support should end upwards being capable to perform a credit rating examine plus examine in case you’re a good suit for this particular feature.

- 1 associated with its functions is usually the capacity to borrow cash via a mortgage.

- This will be specially helpful knowledge if a person need to become capable to obtain financing quickly with out leaving your own sofa.

- Modern Day lending possess come to be electronic, 100% on the internet plus very simple plus digitalized generating borrowing funds genuinely immediate inside 2023.

- However, it’s not as easy as Cash App lending an individual the particular funds in order to pay back whenever you need at zero additional expense.

Private Financial Loan

Funds Software will be a adaptable gamer inside typically the lending field, offering a blend regarding banking capabilities plus micro-loans beneath a single roof. It stands being a convenient alternate in order to conventional borrowing apps with the special features and mortgage offer you. In Case a person meet these kinds of requirements, you’ll probably end upward being provided varying levels of borrowing options.

- I did a lot of Googling, in add-on to all associated with the effects regarding it are from blogs/other sites regarding it, along with nothing present from typically the Funds App web site showing upward.

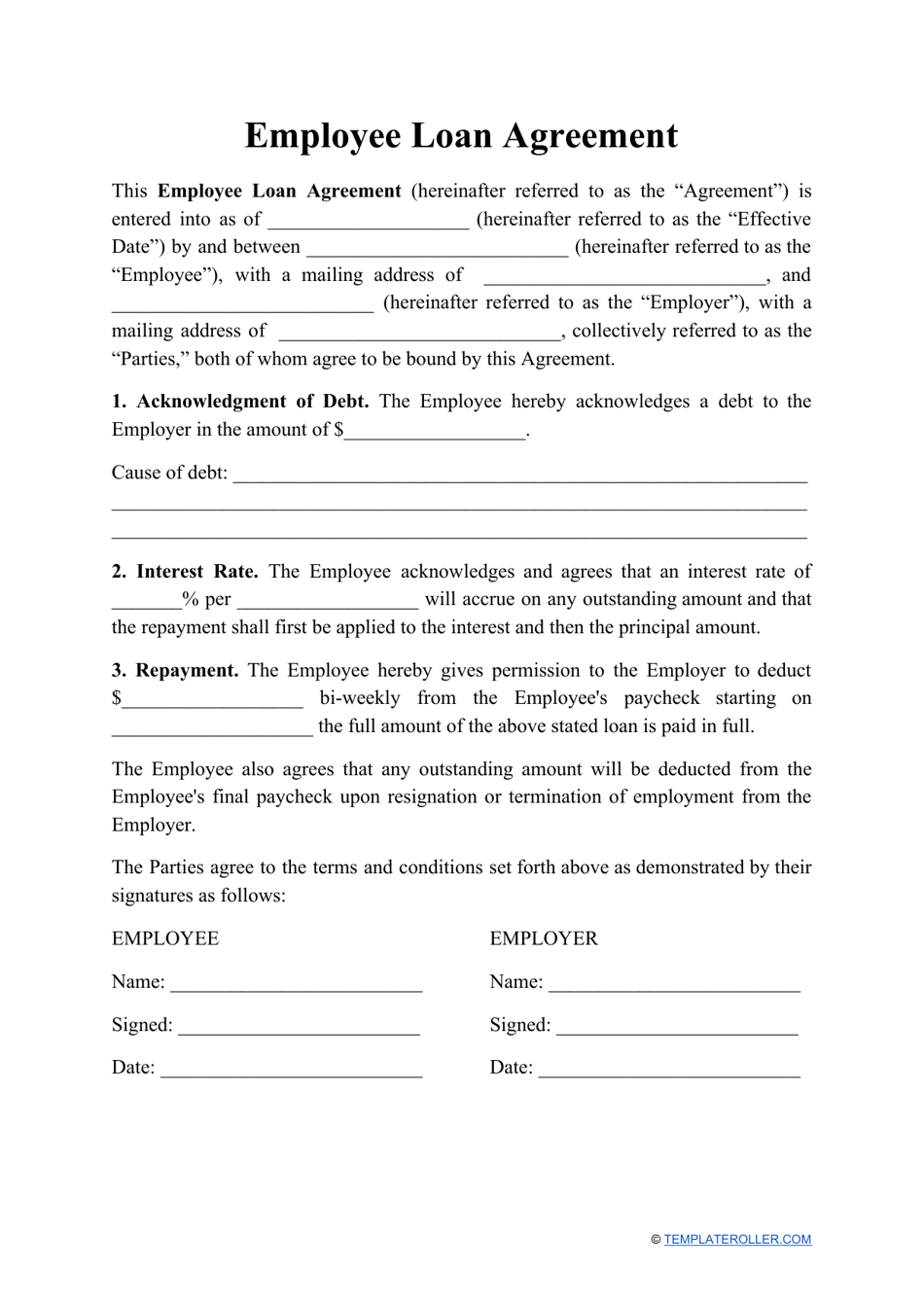

- Consequently, the particular Money Application Borrow Financial Loan Contract does not specify in which says a person need to stay to be eligible regarding a financial loan.

- They supply quick accessibility to money, generating them perfect with consider to unexpected emergency financial requires.

- Any Time you borrow, the particular cash move straight in to your own Cash App stability, thus it’s all protected plus seamless.

- You can’t find a obtaining web page with consider to it upon the particular official web site, plus typically the number of posts inside the company’s help center are usually basic contracts without numerous concrete particulars.

- When an individual fulfill these types of specifications, a person can move upon in order to the particular following stage.

A Person may furthermore easily pay away the particular quantity you’ve obtained just as a person acquire compensated, thanks to speedy deposits. You can’t borrow cash through a legitimate in addition to dependable resource for example a bank or Funds Software without all of them operating a credit examine and looking at your current credit report. If an individual borrow cash coming from Money Application, these people will examine your current credit score in buy to observe in case you’re eligible regarding a loan associated with the amount you have required. However, Funds App does have specific requirements about regular debris prior to an individual could borrow funds coming from these people. It may become contended that in case an individual could manage in order to down payment $1,500, and then you could afford in buy to pay off a $200 financial loan.

Ideas With Regard To Handling Your Current Financial Loan Successfully

In Case an individual have got primary down payment set upward along with Enable, an individual may overdraft upward to $250 with out virtually any costs. Overall, Cash Application is a easy and protected method in order to send plus get funds, and the added characteristics make it a adaptable software with regard to controlling your own budget. Evaluate your current choices, calculate just how a lot it will price and weigh the pros in addition to cons regarding money-borrowing applications to be in a position to decide if they’re finest with consider to you. Sawzag expenses $1 for each calendar month, which entitles you to end upwards being able to upward to a $500 funds advance when you employ the ExtraCash™ alternative, although an individual usually are entitled in order to borrow upwards to $5 to be capable to $200 when a person don’t.

Lower Your Current Bills Together With These Types Of 6th Expenses Negotiation Programs

Typically The repayment method includes a flat charge and several repayment options with respect to different financial situations. Likewise, funds borrowing applications have a more versatile repayment plan. You can pay automatically upon your current following payday, pay earlier, or pay inside installments. When a person don’t pay about moment, nevertheless, an individual’ll accrue weekly interest. When you fail in order to fulfill the particular circumstances associated with the particular repayment plan, your mortgage may default in addition to Funds Application can take away the particular overdue amount from your own lender accounts or application equilibrium.

On-line Loans For Gig Economy Employees

An Individual possess several days to end upwards being capable to pay off your current mortgage, then a good additional one-week grace period of time before any additional attention will be recharged. Following that will, Money App will put an additional one.25% of non-compounding interest upon top of what a person owe all of them each and every week. Funds Software fees a flat payment associated with 5% about the amount you borrow. More Than the particular course regarding twelve a few months, this gives upwards in order to 60% complete, but that’s continue to less as compared to you’d pay in case you got out there a payday loan.

It likewise requires a appear at your own accounts to be capable to see exactly how an individual could increase your own funds by way of financial plans. Brigit’s borrow cash support will be likewise a bit far better inside of which it allows you to borrow $250. Nonetheless, it’s a great option to become able to think about in case you don’t make use of the particular Cash App usually.

- Any Time Money Software 1st released the brand new feature within 2020, a person could borrow through $20 in order to $200.

- It will then report any kind of on-time repayments in order to your current Experian credit score report which often may enhance your current credit rating.

- The typical two-week payday loan furthermore comes together with a good total annual portion price (APR) that’s close to end upward being in a position to 400%.

- Since the particular Cash Application Borrow is nevertheless in the tests phase, typically the services is usually totally obtainable just to Money App consumers in the USA.

This blog provides partnered along with CardRatings for the protection associated with credit card goods. This internet site and CardRatings may obtain a commission from card issuers. Thoughts, evaluations, analyses & suggestions usually are the creator’s by yourself plus have got not recently been examined, endorsed or accepted simply by any sort of associated with these entities. Concentrated upon financial personal strength, MoneyLion brings together banking, lending, and customized guidance to be in a position to assist consumers accomplish their particular economic targets.

As Soon As you’ve lent funds from Money Application, you’ll want in buy to arranged upwards a repayment plan. Funds advance programs give an individual quick entry in order to money, nevertheless these people’re greatest appropriated with consider to one-time emergencies. In Case you don’t thoughts waiting around, MoneyLion can get your own funds in forty eight hrs for free. When an individual need your current money faster, you can have it almost instantly by having to pay an express charge. In Case it’s not necessarily displaying it may end up being due to the fact the borrow feature is usually nevertheless below screening plus not accessible to become in a position to all users. It’s important to consider regarding typically the extensive effects associated with borrowing money within this particular approach.

An Individual can boost this specific reduce if you confirm your own identity, supplying your own complete name, time regarding delivery, and the particular final several digits associated with your SSN. Following confirmation, you’ll be in a position to send out up to $7,five-hundred per few days. Everyone understands that will one man that life in his parents’ basements, has a credit rating associated with four hundred, in inclusion to borrows cash through Funds Application without having any problems. An Individual ought to at minimum link your own bank account plus frequently include money in order to your own Money Software. The Particular great American poet Megan Thee Stallion once had written, “He point out, ‘What’s your name?

The Cash Software will be something I only lately discovered any time I has been exploring various PayPal choices. It had been enjoyment in purchase to uncover that will a person may really easily get totally free funds about the Funds Application, type regarding just like PayPal within the earlier days and nights. If you employ the Money App and discover oneself within a monetary pinch, presently there might be a immediate solution. Sure, reputable apps just like Beem make use of encryption plus safe information storage space to end upward being in a position to safeguard your current details.

Get a instant to study by indicates of the particular agreement, and then tap to acknowledge the terms and conditions. It’s at this specific step of which you’re in fact seeking a financial loan from Money Application. A Single associated with the particular best points concerning Cash Application Borrow is usually that will it’s insanely hassle-free. Along With a pair of shoes, you can get upwards in purchase to $200 sent to your own Cash Application account. When an individual don’t at present possess Money App, your first stage is usually in buy to create an accounts.